Smart Tax Planning for High-Income Earners After the OBBBA: What Really Matters Now

Change Is the Only Constant

I've been working with high-income professionals for over fifteen years now, and if there's one thing I can guarantee, it's this: just when you think you've figured out the tax code, Congress changes it. Again.

The One Big Beautiful Bill Act hit in July 2025 like a curveball nobody saw coming. Rates shuffled, deductions reshuffled, new credits here and there. My phone hasn't stopped ringing since.

But here's what I told a client just last week who was frustrated about having to revisit his whole strategy: "The rules will always change. Your goals probably haven't." That's where real planning comes in—not reacting to every legislative twist, but staying focused on what you're actually trying to accomplish.

What the OBBBA Means for You

Let me cut through the noise. If you're earning good money in Oregon, here's the reality: your top marginal rate remains at 37%. That hasn't changed. But Congress did raise the SALT cap—the limit on state and local tax deductions—from $10,000 to $40,000, which sounds generous at first glance.

What the OBBBA Really Means for High-Income Earners

Key takeaway: Your top marginal rate didn’t change, but your long-term strategy should.

If you’re earning a high income in Oregon or elsewhere on the West Coast, here’s the bottom line:

The top marginal federal rate remains 37%.

The SALT cap increased from $10,000 to $40,000 — but phases out quickly at higher incomes.

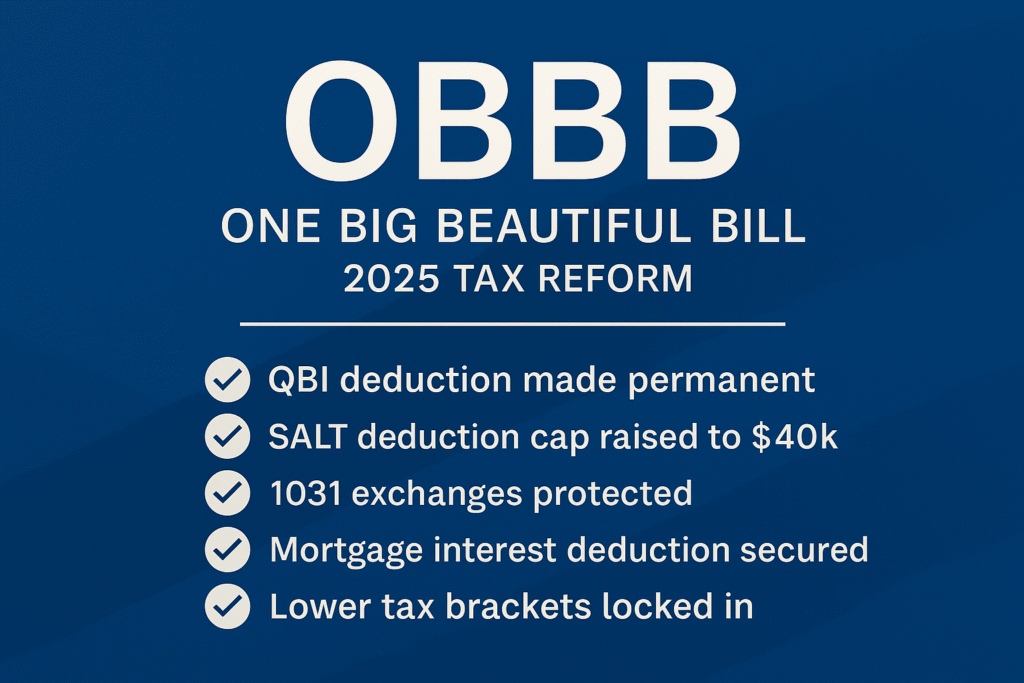

At first glance, the changes seem generous. But the real opportunities come from what didn’t change:

The higher standard deduction is now permanent

Child tax credits increased

The QBI deduction remains

Bonus depreciation survived

For a high-income tax strategy, these tools form a strong foundation, even if other provisions tighten.

The silver lining? Some changes actually create opportunities.

The Oregon Twist Nobody Talks About

Living in Oregon adds another layer that most financial advisors gloss over. While the federal estate exemption climbed to $15 million per person, Oregon's threshold sits stubbornly at $1 million.

That gap matters more than you might think. I work with software engineers, doctors, and business owners who don't see themselves as "estate planning people." Then I show them the numbers: their 401(k), home equity, stock options, maybe that rental property. Suddenly, we're looking at $2-3 million, and Oregon wants its cut.

The estate attorneys I work with are seeing this all the time now. Families are getting hit with surprise state tax bills because nobody planned. It's avoidable, but it requires being proactive about gifting strategies and trust structures.

Expert Perspectives: Tactical Moves That Matter

I recently sat down with Alex Poe, EA, one of the sharp tax strategists we collaborate with, to discuss what he's seeing work for clients navigating the OBBBA changes. Alex's insights on practical implementation are worth paying attention to.

The SALT Cap: Think Long-Term

“Congress raised the SALT cap from $10,000 to $40,000, which sounds generous until you realize it phases out fast at higher incomes. Most high earners? They're not seeing much benefit there,” said Alex.

The benefit may not come now, but if you can control your income in the future and retirement years, it would be beneficial to stay below the phase-out limit to take advantage of the increased deduction. Especially for those in Oregon with one of the highest tax rates in the Country."

This connects directly to Oregon's double tax burden, I mentioned earlier—high state income taxes now, and that low $1 million estate tax threshold later. Strategic income management in retirement becomes a critical planning territory for Oregon residents.

Real Client Example: Strategic Distribution Timing

Alex shared a recent case that illustrates the power of income control in retirement:

"Recently, I was able to help a client control their income by taking a distribution in December 2025 and a planned distribution in January 2026, so they straddled two tax years to take advantage of the additional SALT deduction. While not available to all, it's something to consider as you approach retirement and your wage income decreases."

This is exactly the kind of tactical move that requires coordination between your wealth advisor and tax preparer. The client needed to take a certain amount from their retirement accounts, regardless—the strategy was simply about timing. By splitting the distribution across two tax years, they stayed under the SALT cap phase-out threshold in both years and maximized their deductions.

It's not flashy. You won't see it featured in financial magazine headlines. But it's real money saved through thoughtful planning.

Why Bunching Your Giving Makes Sense Now

When clients ask what they can actually do about the tax changes, charitable giving often tops my list. Not because it's a magic bullet, but because it's one of the few strategies that gets more powerful when combined with smart timing.

The math has shifted with these higher standard deductions. Spreading your charitable gifts evenly year by year? That often doesn't move the needle anymore. But "bunching" contributions—giving two or three years' worth in a single tax year—can unlock real deductions.

I've been using Donor-Advised Funds more with clients lately. You make the big gift in a high-income year, claim the deduction when it matters most, then distribute to charities over time. It's a tax strategy that aligns with your values, which honestly feels better than most planning moves.

Alex has been analyzing how the new rules affect charitable strategies. Starting in 2026, OBBBA introduces a 0.5% floor on charitable deductions—only contributions exceeding 0.5% of your AGI are deductible. For a $1 million earner, that's the first $5,000 lost to the floor every year. "If you can control your charitable giving timing," Alex notes, "bunch contributions in high-income years to minimize the floor's impact." His analysis shows spreading $100K annually over ten years means $50K generates no deduction, versus just $5K lost when concentrated in one year—a $45K difference through timing alone.

Planning vs. Reacting

Look, every time Congress rewrites the rules, there's this urge to panic and overhaul everything. I get it. But twenty years of doing this work has taught me that good planning isn't about finding the one perfect strategy. It's about building systems that can adapt.

The process stays the same even when the rules change:

Take a breath and really understand what shifted

Map the changes against what you're trying to accomplish

Adjust your approach, not your destination

Sometimes the best move is no move at all. Sometimes it's a complete strategy pivot. The key is making that decision deliberately, not reactively.

What I’m Telling Clients Right Now

Key takeaway: Congress will change the rules again — your plan should be built to withstand it.

The OBBBA isn’t the last legislative curveball. Another major reform package will arrive. Then another after that.

But your long-term goals, financial independence, family security, and charitable impact shouldn’t change every election cycle.

At North Ridge, we help busy, high-income professionals navigate these shifts with confidence.

Whether you need:

A high-income tax strategy update

Oregon estate tax planning

Charitable optimization

SALT deduction planning

Retirement income control strategies

Integrated tax + wealth + estate coordination

We’ll make sure your plan evolves with the times while keeping what matters most at the center.

At North Ridge, we specialize in helping busy professionals navigate exactly these kinds of transitions. Whether we're modeling new tax scenarios, updating estate plans for Oregon's quirky rules, or restructuring charitable giving strategies, the approach is consistent: understand the changes, protect what matters most, and adapt thoughtfully.

If you're wondering how the OBBBA affects your specific situation, let's schedule a conversation. Together, we'll make sure your plan evolves with the times while keeping your long-term goals front and center.

Disclosure: The information provided in this article is for general educational purposes only and should not be considered financial or tax advice. Please consult with a qualified professional regarding your individual situation before making any financial decisions.