WINNING THE INVESTMENT GAME

HOW GOOD INVESTMENTS + GREAT BEHAVIOR = BETTER PERFORMANCE

Investing can be complicated, but to win the investment game, you need only focus on the things that matter and that you can control. Anything else is just a distraction that will separate you from your hard-earned money.

You might be surprised at just how few things meet this criteria. Below we outline three rules, we like to call these “The 3 ‘Ds’ of Investing” as they are the keys to your success. To quote Warren Buffett, “it’s simple, but not easy.”

WHAT IS IT?

An investment’s total cost can be comprised of many factors: expense ratio, distribution fee, sales load, transaction fees, and taxes. According to the Investment Company Institute, the average actively managed fund cost 0.71% in 2020 vs. 0.06% for the average index fund.

WHY IS IT IMPORTANT?

It’s simple math. Every dollar you pay is one less dollar in your pocket. “But, I’m paying an expert to deliver superior returns,” you say. Not so quick. Do you know 90% of “experts” underperform their benchmark over time (see page 9)? Fund expenses, it turns out, are the best predictor of future performance. When it comes to investing, you often get what you don’t pay for.

WHEN DO INVESTORS GO ASTRAY?

Investors often succumb to the temptation to chase performance—investing in funds with a recent hot streak, regardless of the high expense ratios, redemption fees, sales loads, or taxes involved.

HOW DOES NORTH RIDGE DRIVE DOWN COSTS?

We use low-cost, tax-efficient index funds as the building blocks of our portfolios. The weighted average cost of our portfolios is ~0.17%—about 1/4 the cost of the average actively managed mutual fund!

We also lower your tax bill through asset location—strategically holding assets in accounts (taxable, tax-deferred, or tax-free) that minimize lifetime taxes.

Drive down costs to keep returns.

Discipline leads to higher returns.

WHAT IS IT?

Diversification is combining many “risky” assets (that are not alike) to create a portfolio of assets with less overall fluctuation in returns.

WHY IS IT IMPORTANT?

Diversification is the only “free lunch” when it comes to investing. Why? Because when one asset “zigs,” another “zags” resulting in higher returns with lower risk than the individual components. Who doesn’t want that?

WHEN DO INVESTORS GO ASTRAY?

The three most common mistakes:

focusing on home runs (Apple, Amazon...)

owning employer stock (if your employer fails, you lose your job and your wealth…Enron anyone?)

owning companies in the same industry

HOW DOES NORTH RIDGE DIVERSIFY?

We use enhanced index funds as the building blocks of our portfolios because they offer complete diversification (over 15,000 securities). This includes domestic and foreign stocks, bonds, and real estate.

Because bonds are held for wealth preservation, we own government-issued treasuries (foreign & domestic) as they perform best during stock market crises—precisely what you want from your “safe” assets.

Diversify for smoother returns.

WHAT IS IT?

Discipline is having a sound investment strategy and sticking to it, even when it feels like the wrong thing to do.

WHY IS IT IMPORTANT?

It helps you avoid the perils of stock-picking and market-timing in the endless pursuit of returns—at least until you go broke. Both are an exercise in futility, though Wall Street would love to convince you otherwise.

WHEN DO INVESTORS GO ASTRAY?

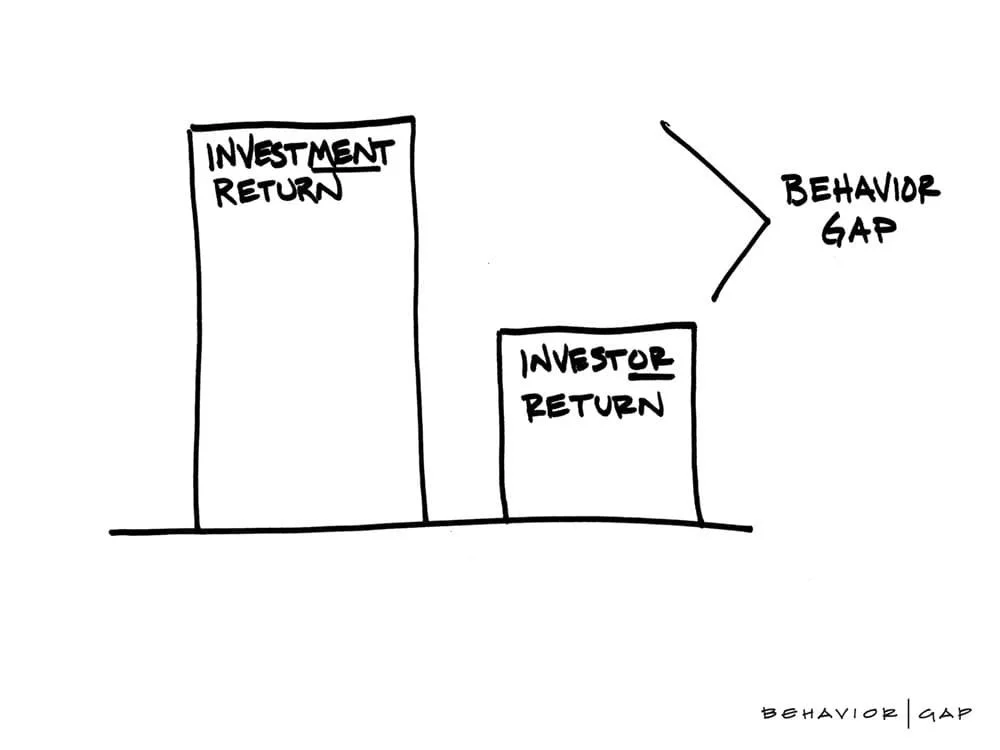

Unfortunately, way too often. Studies consistently show that the average investor underperforms the market. Why? Because they let emotion dictate their actions, chasing that elusive hot fund manager or the next Amazon.

HOW DOES NORTH RIDGE STAY DISCIPLINED?

We set rebalancing thresholds around asset classes to ensure we buy low, sell high, rinse and repeat until rich. Simple in principle, but not easy in practice. That, and we ignore the noise coming from CNBC and their ilk.

Delegate for the best odds of success.

Not sure you have the time or discipline to implement these rules? That’s ok, you’re not alone. Numerous studies show the typical investor underperforms the market by 2-4% per year. That’s a lot of money left on the table.

Lets be honest, for most people, managing wealth is like watching paint dry. But what if there was a better option? Why not delegate it to a financial advisor with the time, know-how, and fortitude to help you tackle your toughest financial challenges? Imagine being able to “tune out the noise” and focus on what you value and enjoy most. Instead of exhausting you, let your wealth empower you to live your best possible life?